The Facts About Custom Private Equity Asset Managers Revealed

Wiki Article

Facts About Custom Private Equity Asset Managers Revealed

You have actually probably listened to of the term exclusive equity (PE): buying firms that are not openly traded. Approximately $11. 7 trillion in assets were taken care of by exclusive markets in 2022. PE companies look for possibilities to make returns that are better than what can be attained in public equity markets. There might be a couple of points you do not comprehend concerning the industry.

Private equity firms have a variety of investment choices.

Due to the fact that the very best gravitate toward the larger bargains, the center market is a dramatically underserved market. There are more vendors than there are highly experienced and well-positioned financing experts with comprehensive customer networks and resources to handle an offer. The returns of exclusive equity are typically seen after a couple of years.

A Biased View of Custom Private Equity Asset Managers

Traveling have a peek at these guys below the radar of big multinational firms, a number of these small companies commonly give higher-quality client service and/or specific niche products and solutions that are not being offered by the large empires (https://codepen.io/cpequityamtx/pen/VwgqKQX). Such upsides bring in the interest of private equity firms, as they possess the understandings and wise to exploit such possibilities and take the business to the following level

Many managers at portfolio firms are offered equity and reward settlement frameworks that award them for striking their economic targets. Exclusive equity opportunities are commonly out of reach for people who can't invest millions of dollars, however they shouldn't be.

There are guidelines, such as limits on the aggregate amount of cash and on the number of non-accredited capitalists (Asset Management Group in Texas).

The Greatest Guide To Custom Private Equity Asset Managers

One more downside is the lack of liquidity; when in a private equity deal, it is not very easy to get out of or market. With funds under monitoring currently in the trillions, private equity companies have actually come to be attractive investment automobiles for rich people and institutions.

For years, the features of exclusive equity have made the possession course an eye-catching proposition for those who can take part. Since access to exclusive equity is opening approximately more specific capitalists, the untapped possibility is coming true. The question to think about is: why should you spend? We'll start with the main debates for purchasing personal equity: How and why personal equity returns have traditionally been greater than various other properties on a number of levels, Exactly how including private equity in a portfolio impacts the risk-return profile, by helping to expand versus market and cyclical threat, After that, we will certainly describe some key considerations and risks for exclusive equity capitalists.

When it pertains to presenting a brand-new possession right into a profile, one of the most standard factor to consider is the risk-return account of that possession. Historically, exclusive equity has actually exhibited returns similar to that of Emerging Market Equities and higher than all other standard asset classes. Its fairly reduced volatility combined with its high returns creates an engaging risk-return profile.

The Best Strategy To Use For Custom Private Equity Asset Managers

Actually, exclusive equity fund quartiles have the widest range of returns throughout all alternative possession classes - as you can see below. Technique: Internal rate of return (IRR) spreads computed for funds within classic years individually and afterwards balanced out. Average IRR was calculated bytaking the average of the average IRR for funds within each vintage year.

The result of including private equity into a profile is - as always - reliant on the profile itself. A Pantheon research study from 2015 recommended that including personal equity in a profile of pure public equity can open 3.

On the other hand, the ideal personal equity companies have accessibility to an even larger pool of unknown possibilities that do not encounter the exact same analysis, as well as the sources to do due persistance on them and recognize which are worth investing in (Private Investment Opportunities). Investing at the very beginning suggests higher risk, but also for the companies that do prosper, the fund gain from higher returns

Rumored Buzz on Custom Private Equity Asset Managers

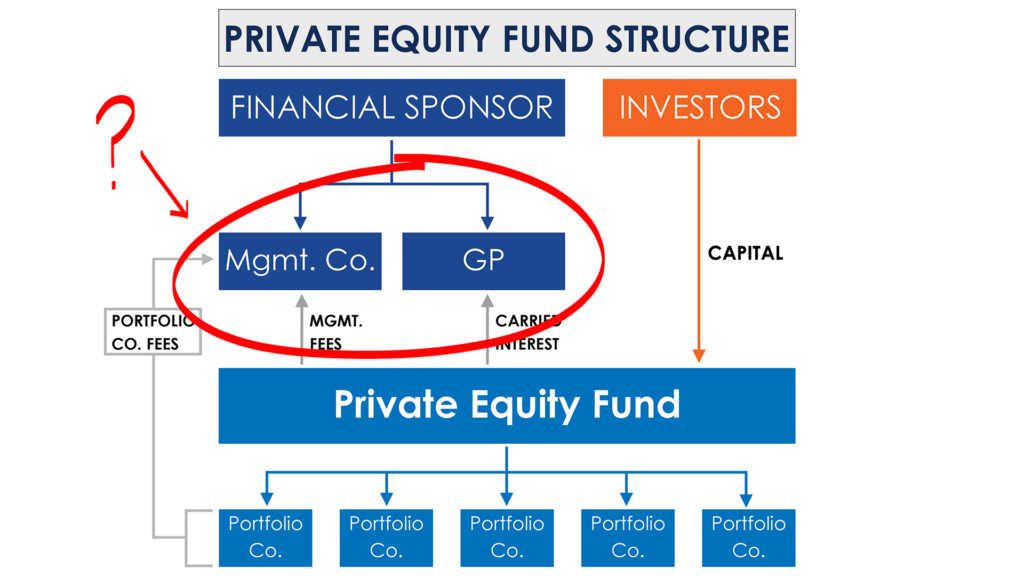

Both public and exclusive equity fund supervisors commit to spending a percentage of the fund but there stays a well-trodden issue with aligning interests for public equity fund management: the 'principal-agent issue'. When a financier (the 'major') employs a public fund supervisor to take control of their capital (as an 'agent') they delegate control to the manager while maintaining possession of the assets.

In the situation of exclusive equity, the General Companion does not just earn a management cost. Private equity funds likewise mitigate one more kind of principal-agent trouble.

A public equity financier eventually desires something - for the management to enhance the supply price and/or pay dividends. The capitalist has little to no control over the choice. We revealed above the number of exclusive equity methods - particularly bulk buyouts - take control of the operating of the company, making certain that the long-term value of the company comes first, raising the return on financial investment over the life of the fund.

Report this wiki page